Table Of Content

The interest rate does not change for the first five years of the loan. After that time period, however, it adjusts annually based on market trends until the loan is paid off. The interest rates are usually comparable to a 30-year mortgage, but ARMs transfer the risk of rising interest rates to you—the homeowner. A quick conversation with your lender about your income, assets and down payment is all it takes to get prequalified. But if you want to get preapproved, your lender will need to verify your financial information and submit your loan for preliminary underwriting.

Free home loan calculator: Estimate the monthly payment breakdown for your mortgage loan, taxes and insurance

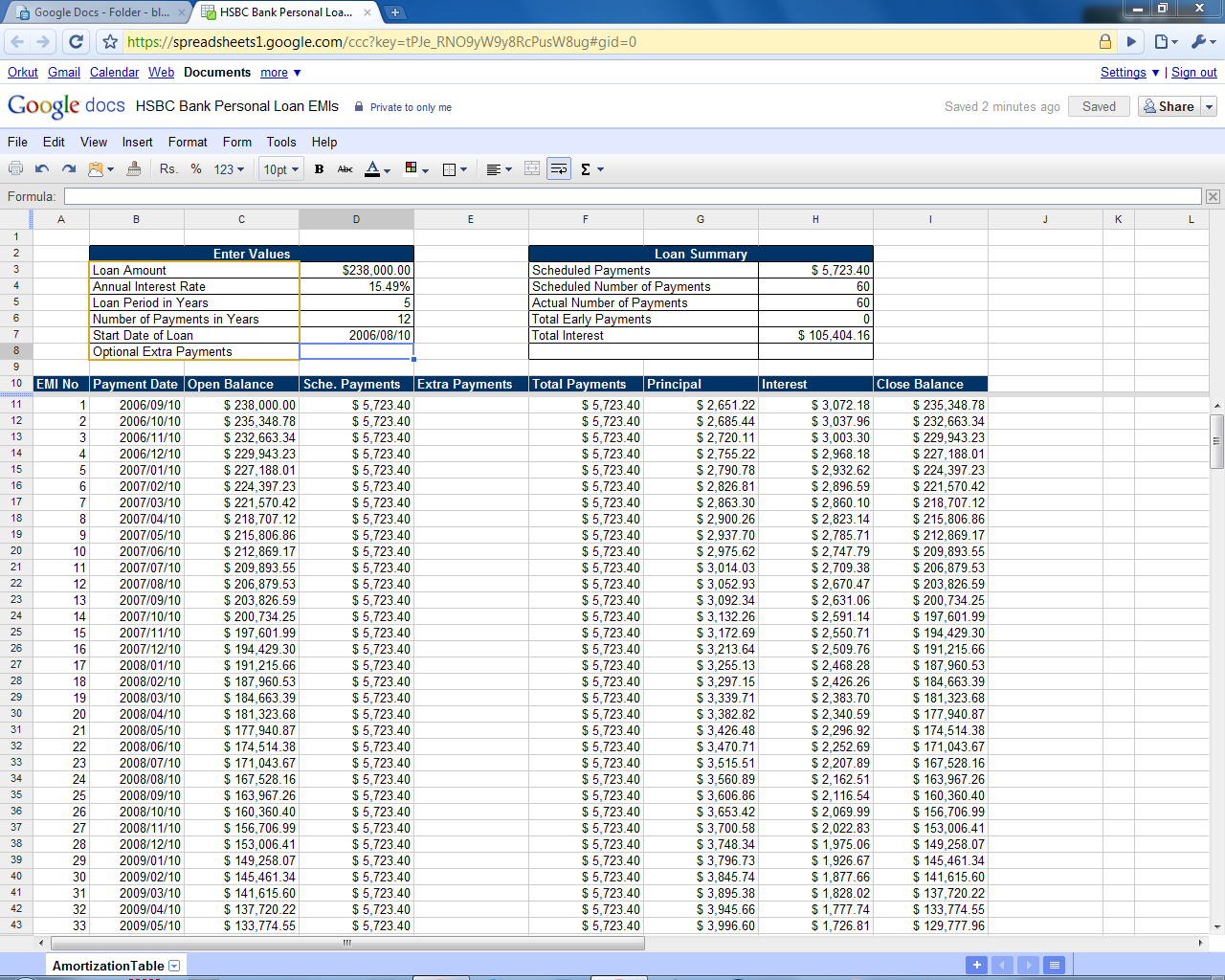

Reducing the amount you need to borrow, even by a little bit, will lower the amount you pay in interest over time, and it can lower your monthly payments as well. Your current principal and interest payment is $993 every month on a 30-year fixed-rate loan. You decide to make an additional $300 payment toward principal every month to pay off your home faster. By adding $300 to your monthly payment, you’ll save just over $64,000 in interest and pay off your home over 11 years sooner. Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term.

How to be Eligible for a Conventional Loan

Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. This formula can help you crunch the numbers to see how much house you can afford. Alternatively, you can use this mortgage calculator to help determine your budget. In addition, the calculator allows you to input extra payments (under the “Amortization” tab).

How a Larger Down Payment Impacts Mortgage Payments*

You’re required to pay PMI if you don’t have a 20% down payment and you don’t qualify for a VA loan. The reason most lenders require a 20% down payment is due to equity. If you don’t have high enough equity in the home, you’re considered a possible default liability. In simpler terms, you represent more risk to your lender when you don’t pay for enough of the home. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan.

Common Mortgage Questions

For 2022, the FHFA set conforming limits for single-unit homes in the U.S. continental baseline at $647,200. As for areas where house prices are expensive, the ceiling is at 150 percent. This means the conforming limit for single-unit homes in high-cost areas is $970,800. While preparing, you should know about different mortgage options available in the market. Though it may sound overwhelming, once you’re well-informed, it should help you make better decisions. You may even save more by choosing the appropriate mortgage option.

HOA fees are an additional ongoing fee to contend with, they don’t cover property taxes or homeowners insurance in most cases. Additionally, some lenders have programs offering mortgages with down payments as low as 3% to 5%. The table below shows how the size of your down payment will affect your monthly mortgage payment. Many mortgage lenders generally expect a 20% down payment for a conventional loan with no private mortgage insurance (PMI). One of the rules you may hear as a homebuyer is the 28/36 rule or the debt-to-income (DTI) rule. This rule says that your mortgage payment shouldn’t go over 28% of your monthly pre-tax income and 36% of your total debt.

Start your home buying research with a mortgage calculator

The fees cover common charges, such as community space upkeep (such as the grass, community pool or other shared amenities) and building maintenance. Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage (hail, wind and lightning) to your home. Flood or earthquake insurance is generally a separate policy.

Comparing Conventional Loans to Other Mortgage Options

The total is divided by 12 months and applied to each monthly mortgage payment. If you know the specific amount of taxes, add as an annual total. Your monthly payment represents the total amount you pay for your mortgage (principal and interest), homeowner’s insurance, property taxes, and neighborhood HOA fees.

Keep your debt-to-income ratio low

Delaware Mortgage Calculator - The Motley Fool

Delaware Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

That estimate assumes a 6.9% interest rate and at least a 20% down payment, but your monthly payment will vary depending on your exact interest rate and down payment amount. Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or we’ll estimate the costs based on the state the home is located in. Then, click “Calculate” to see what your monthly payment will look like based on the numbers you provided.

Shorter time horizons will require larger monthly payments, but you’ll pay less in interest over the life of your loan. You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. Edit these figures by clicking on the amount currently displayed. Most recurring costs persist throughout and beyond the life of a mortgage. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox.

Make sure you have large savings to shoulder 3 to 6 percent of the home’s total value. They can even apply for a new VA loan despite defaulting on a loan from years back. Qualified borrowers are also allowed to refinance to a lower rate, or shift to an adjustable rate mortgage or fixed-rate loan.

I did my manifestation course about two months ago, and I have done as I was instructed - my abundance board is up in sight inside the flat, and I often have a cup of coffee in front of it. "They weren't more objectively successful in terms of having higher income or higher education attainment," he said. And while I'd love a big cash injection, Tansy explained to me that money is "only a stepping stone to a feeling" and, ultimately, I'm aiming to create an emotion with it.

Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home. You can also try our home affordability calculator if you’re not sure how much money you should budget for a new home. A mortgage rate is the rate of interest charged on a mortgage. They can be either fixed, staying the same for the mortgage term or variable, fluctuating with a reference interest rate. Interest rate - Estimate the interest rate on a new mortgage by checking Bankrate's mortgage rate tables for your area. Once you have a projected rate (your real-life rate may be different depending on your overall financial and credit picture), you can plug it into the calculator.

No comments:

Post a Comment